Workforce Training

and Development

Supporting Employers

Worcester County strategically realizes opportunities for existing business expansion, and regional attraction of new industries, through investment in innovative workforce training and education pathways that help workers acquire skills to fill good jobs in alignment with identified regional business and industry workforce skill-gaps; a key factor in accelerating economic development and recovery.

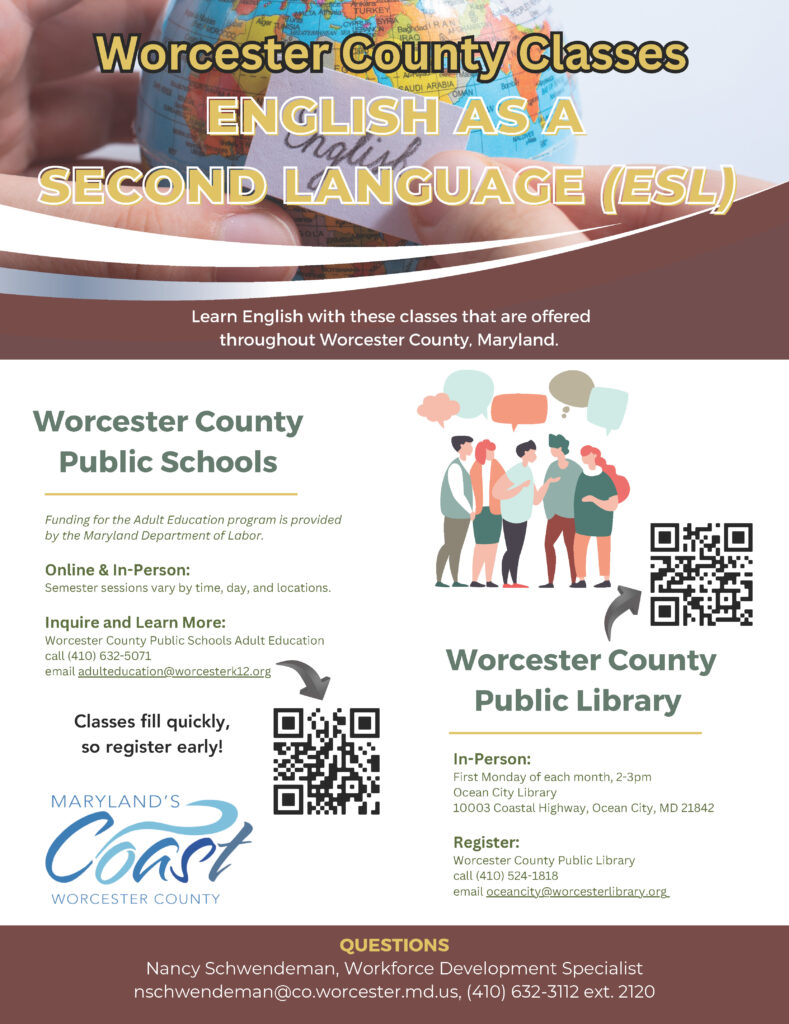

English As A Second Language (ESL) Classes

Learn English with these classes that are offered throughout Worcester County, Maryland.

Community Investment

- Addressing low-work skills and skill gaps by strategically building a regional talent pipeline and by creating educational and career pathways filling workforce requirements for key industries in Worcester County.

- Workforce training and education are essential parts of economic development and recovery.

- Effectively utilizing taxpayer dollars to achieve workforce developmental goals.

- Enhancing economic stability by establishment of efforts including outreach activities supporting industry partnerships.

- Providing business attraction and expansion opportunities offering a suitable workforce skill-set alignment.

Setting Worcester County Apart

- Worcester County is designated as a U.S. Small Business Administration HUBZone – attracting businesses seeking federal contracting opportunities.

- State income and real property tax credits for businesses locating or expanding in Berlin, Snow Hill, and Pocomoke City – the 3 Enterprise zones.

- Dedicated Workforce Development Specialist – delivering workforce development programs and services to meet Worcester County business needs as coordinated with local, state and regional partners.

Available Resources

Work Opportunity Tax Credit: This federal tax credit is available to businesses who hire and retain employees from various target groups that face significant barriers to employment.

Maryland Disability Employment Tax Credit: This tax credit allows businesses to claim a credit for employees with disabilities as specified by the Americans with Disabilities Act in order to enhance employment opportunities for the disabled workforce.

Hire Our Veterans Tax Credit: This program provides a State income tax credit to small businesses who hire qualified veterans. The credit is based on wages paid to those veteran employees.

Maryland Enterprise Zone Tax Credit: A tax credit is available to businesses located in an Enterprise Zone that hire employees to fill newly created jobs. Businesses located in a Focus Area may also qualify for enhanced credits.

Maryland Registered Apprenticeship Tax Credit: Businesses who participate in the Registered Apprenticeship Program may qualify to receive a $1,000 state income tax credit for each eligible Registered Apprentice that is hired.

Maryland Hiring Agreements: Through state hiring agreements, job-seekers can apply for qualifying jobs offered by participating companies that operate under State procurement contracts before the employment announcements are made public.

On-the-Job Training Wage Reimbursements: Businesses who hire a qualified employee with a disability are eligible to be reimbursed by the Division of Rehabilitative Services for the employee’s wages while they receive professional training.

Resources

Workforce Training Grants

- Maryland Business Works: This matching fund incumbent worker training grant supports private sector businesses in building employee productivity, upgrading skillsets, and creating opportunities for expanding the existing workforce.

- Partnership for Workforce Quality: This program provides matching grants and workforce training to employees at manufacturing and technology companies located in Maryland.

- Employment Advance Right Now (EARN): This industry-led workforce development grant program targets low-income and no-skilled workers to eliminate barriers to employment and create formal career paths.

- Jobs for Veterans State Grant: This program helps transitioning service members and veterans find jobs by providing employment services at American Job Centers.

Maryland Apprenticeship and Training Program (MATP) – Division of Workforce Development and Adult Learning (state.md.us) – Looking for a solution to building a reliable, highly skilled pipeline of employees? Need a succession plan for your retiring workforce? LABOR’s Registered Apprenticeship initiative can help. info@mdapprenticeship.com

- Build your workforce. Registered apprenticeship trains workers in the specific skills needed by your company.

- Reduce turnover costs. Registered apprentices boast an impressive 91% retention rate.*

- Increase productivity. Apprentices report high levels of motivation, satisfaction, and loyalty. For every dollar spent on apprenticeship, U.S. employers get $1.47 back in increased productivity. **

- Make your workplace safer. A well-trained workforce may reduce worker compensation costs.

- Plan for employee succession. Registered apprenticeships help you to successfully facilitate the transfer of knowledge from experienced employees to new recruits.

- Take advantage of tax credits and financial incentives. Maryland offers businesses valuable support to build a reliable pipeline of qualified workers.